Cryptocurrency is sparking curiosity at Skyline High School, with students beginning to explore its potential benefits as a financial tool.

Cryptocurrency, often referred to as crypto, is a form of digital currency that uses cryptography as a method of securing information through complex codes to ensure security. It operates on decentralized networks called blockchains.

As digital finance evolves, understanding crypto is becoming just as important as learning about traditional banking. However, many students are left to figure out how to do it on their own.

Financial experts argue that cryptocurrency’s volatility makes it an unreliable focus for education. They highlight cryptocurrency’s instability, marked by sharp declines after periods of high demand and warn that promoting it in schools may be too soon. Skyline High School does not currently offer courses on cryptocurrency. “I’ve taken accounting and personal finance, but none of these classes cover crypto,” said Abhinav Honnikoppa (’25). “I think Skyline should add at least basic fundamentals of what crypto is and how it works.”

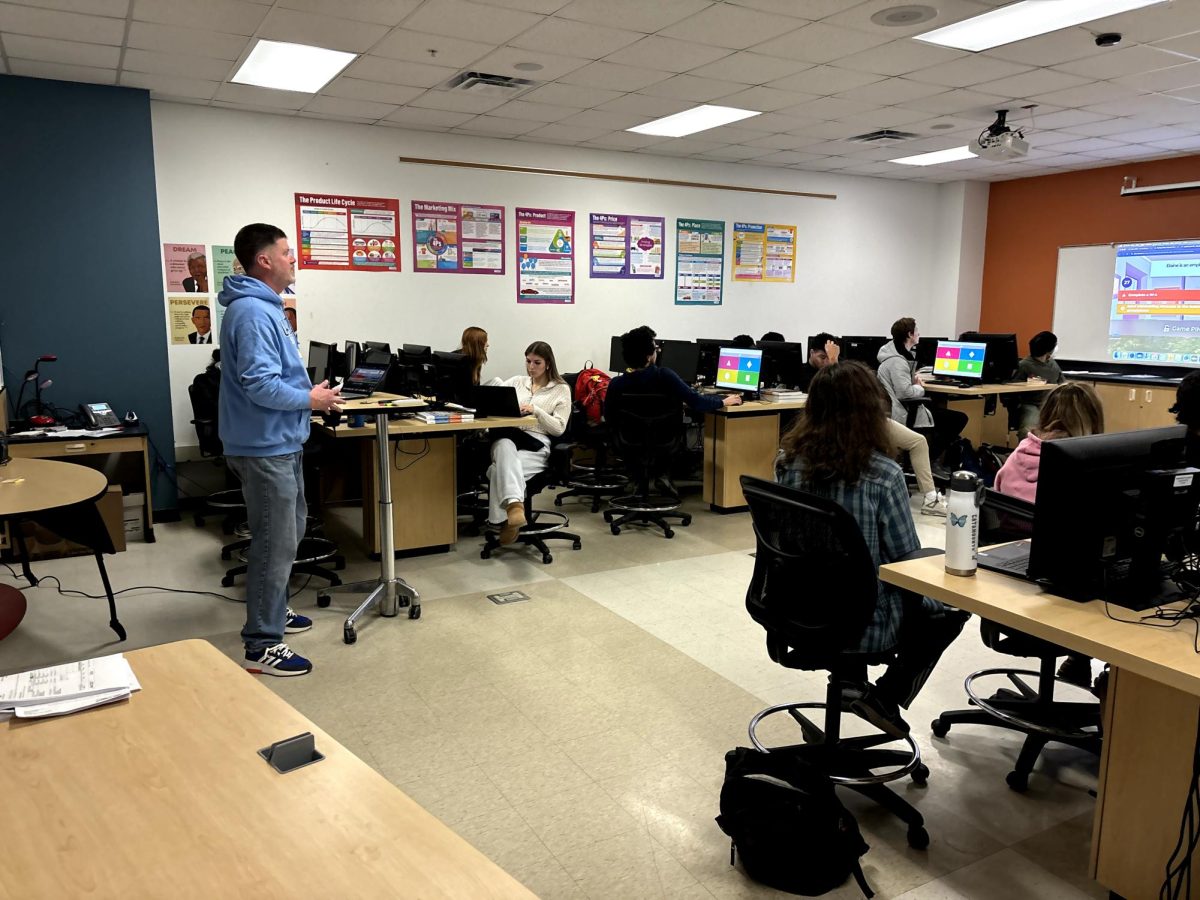

According to Scott Sprow, the personal financial teacher at Skyline, the widespread availability of information is a significant factor in students’ interest in crypto. “The availability of information at your age is so much more advanced compared to when I was in school,” said Sprow. “Students need as much exposure to financial literacy as possible, and cryptocurrency, while volatile, is a big part of the future. It’s important for students to learn about it and figure out if it’s something for them.”

Some students are taking matters into their own hands by researching and experimenting with cryptocurrency independently. Honnikoppa states that, “I would definitely recommend students, especially our age, to get invested in crypto, just because of the learning potential and the amount of money that you could possibly make. We’re moving into a more digital age, and it’s important to understand how it works.”

However, not everyone is as enthusiastic about cryptocurrency. “I choose to kind of stay away from it until I’m kind of more knowledgeable on it,” says Colin Dybdahl (‘25). “I want to make sure before I kind of go into a world that’s kind of a little more inconsistent, I want to know more about how the market works. I have a few buddies of mine who do invest. They’ve had very inconsistent results and that’s why I’m hesitant to jump into the market.”

Despite these concerns, the push for including crypto education in financial literacy continues to grow. Sprow emphasizes the need for a balanced approach of multiple topics. According to Sprow, students should learn about personal finance broadly, savings, budgeting, and investing and explore cryptocurrency as a small, but relevant, part of that. While Skyline hasn’t added crypto to its curriculum yet, students and teachers alike recognize the importance of financial literacy in an evolving digital economy.